$100,000 in Dividend Growth Stocks has the ability to pass your full-time job income.

Let me explain.

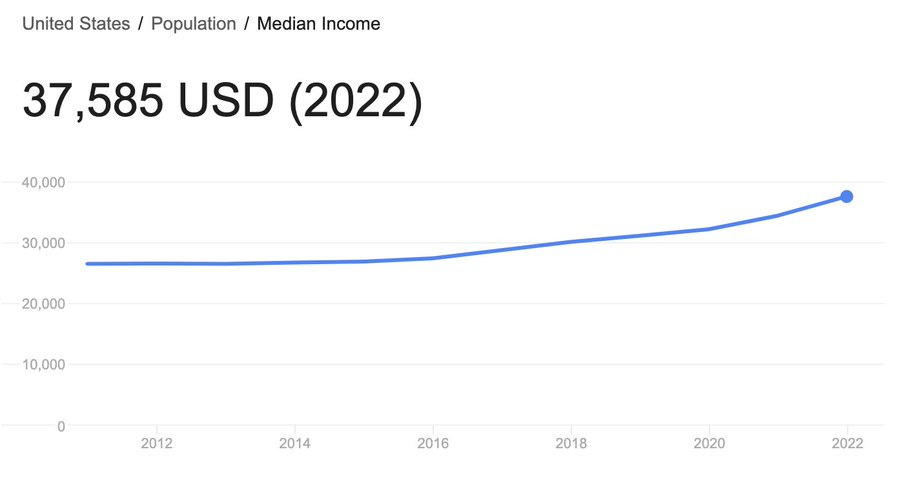

In 2022, the median income in the United States was $37,585.

But $100,000 in dividend growth stocks can completely replace this income.

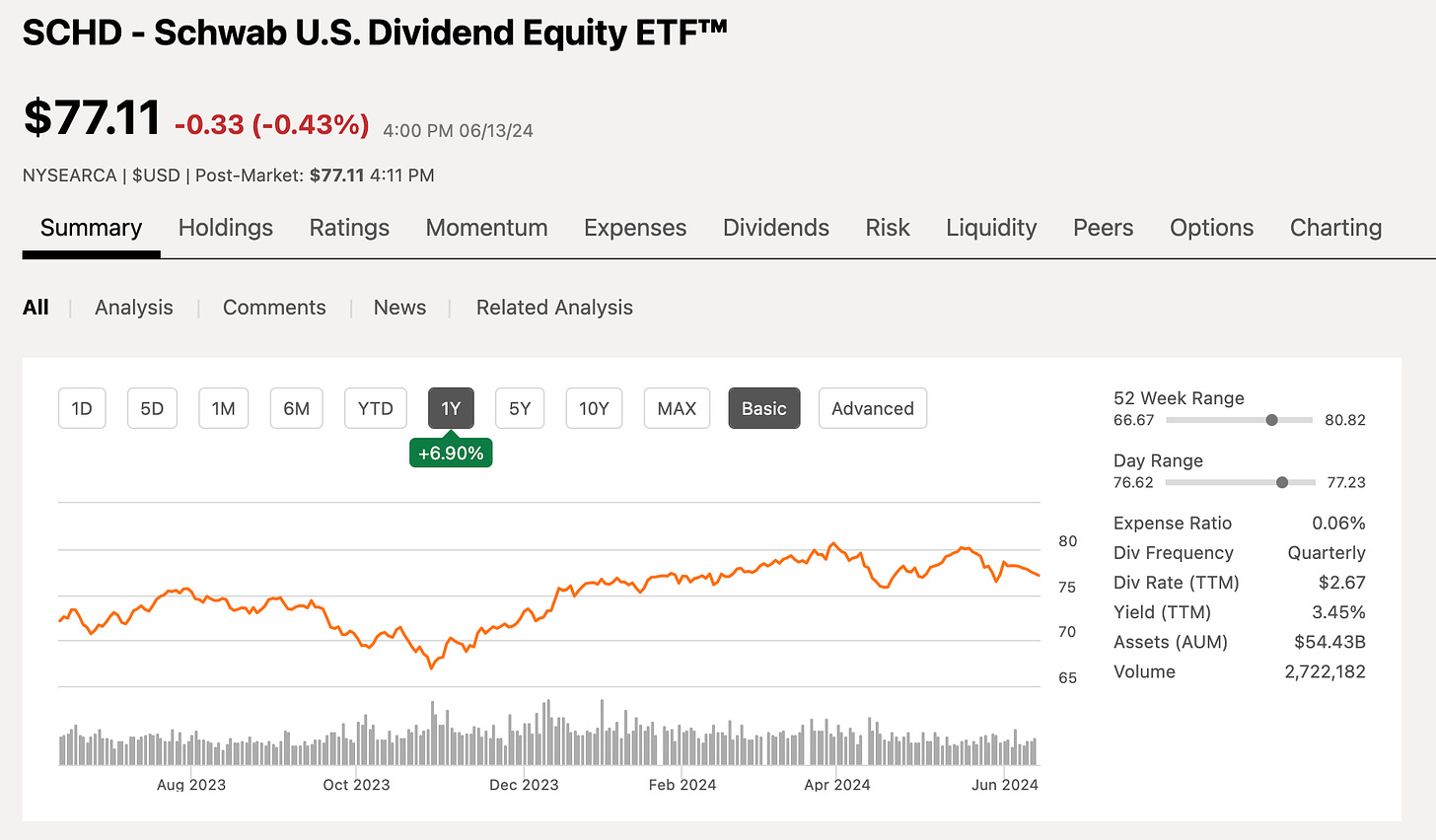

The popular dividend growth ETF SCHD currently has a starting yield of about 3.50%.

This means that if we invested $100,000 into this fund, it would generate around $3,500 in dividends over the next year. This isn't close to replacing the $37,585 median salary.

So, not impressed with SCHD?

That's ok.

The magic isn't in the current yield... It's in the funds ability to increase the amount it pays out in dividends every single year.

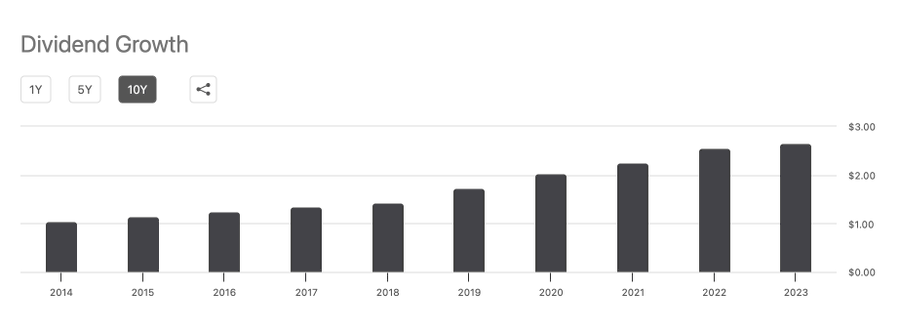

For example, the fund paid out $1.05 in dividends in 2014. But in 2023, it paid out $2.66.

Over the past 10 years, the fund has compounded annual dividend growth rate of 10.87%.

And this is what gives $100,000 in dividend growth stocks the ability to pass your full time income.

Let's look at an example:

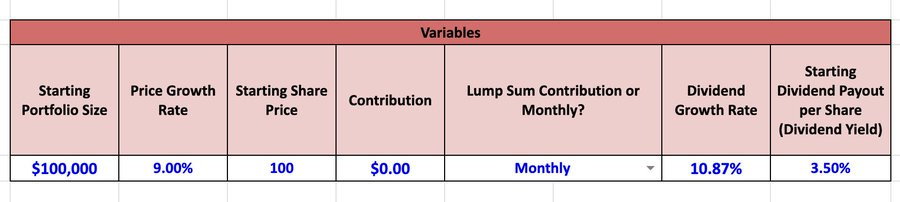

Let's assume we invest $100,000, and never make anymore contributions.

Let's also assume:

The yield is 3.5% (SCHD's current yield)

10.87% dividend growth (SCHD's 10 YR average)

9% share price growth

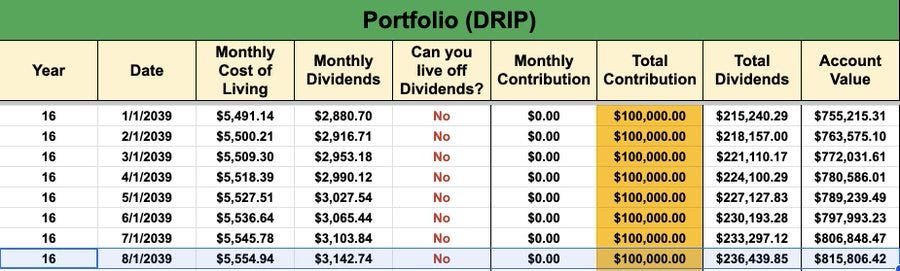

After a little over 16 years... Monthly dividends would be $3,142.74, putting your annual dividend income at $37,712.83!

This means your annual dividend income would surpass your full time job!

Your account value would also be above $815,000!

Remember:

This is with a 1 time contribution, in reality, the amount of time it would take to get there would be much lower if you simply made small monthly contributions as well.

Median income will also slowly increase over time due to inflation

Reinvesting dividends plays a major role in causing the compounding effect as well. While there is not one perfect example and many variables at play, this example still demonstrates the power of compounding, and why getting that first $100,00 invested is so important.

Again, dividend growth investing can do much more than replace a salary of $37,585.

In fact, I’m projecting that in 20 years, I could make be making close to $120,000 a year in dividends, or $10,000 a month!

The key is to get started, buy quality dividend growth companies, make consistent contributions, reinvest dividends, and sit back and let the compounding snowball effect take place.

Check out these resources:

Tickerdata 🚀 (My automated spreadsheets and instant stock data for Google Sheets!)

Interactive Brokers 💰 (My favorite place to buy and sell stocks all around the world!)

Seeking Alpha 🔥 (My favorite investment research platform!)

Other News…

At the end of every month, I send out a newsletter to my paid newsletter subscribers with a list/spreadsheet of all the dividend stocks that I believe to be currently undervalued.

This sheet was received by nearly 200 dividend investors last month. (Wow!)

If you’d like to receive this sheet at the end of this month, you can sign up here:

I plan on sending out this month’s edition in the next couple of days, so sign up soon if you want to receive it.

That’s all for now!

See you next week!

Dividendology