While Wall Street Wizards have their algorithms and suits, the mindset of someone with overalls and a pair of well-worn boots might be the real savvy investor.

To craft a thriving portfolio, there's one essential skill one must master:

Adopt the mindset of a farmer.

Farmers have 7 principles them a hand up as an investor.

1. Don’t Shout at the Crops

Investing is a long term game.

Short term, share price follows market sentiment.

Long term, share price follows earnings growth.

So even when there is short term volatility with your stocks, be sure not to shout at the crops. Strong emotions only lead to poor investing decisions.

2. Don’t Blame the Crop for not Growing Fast Enough

A general rule that has proven to be true-

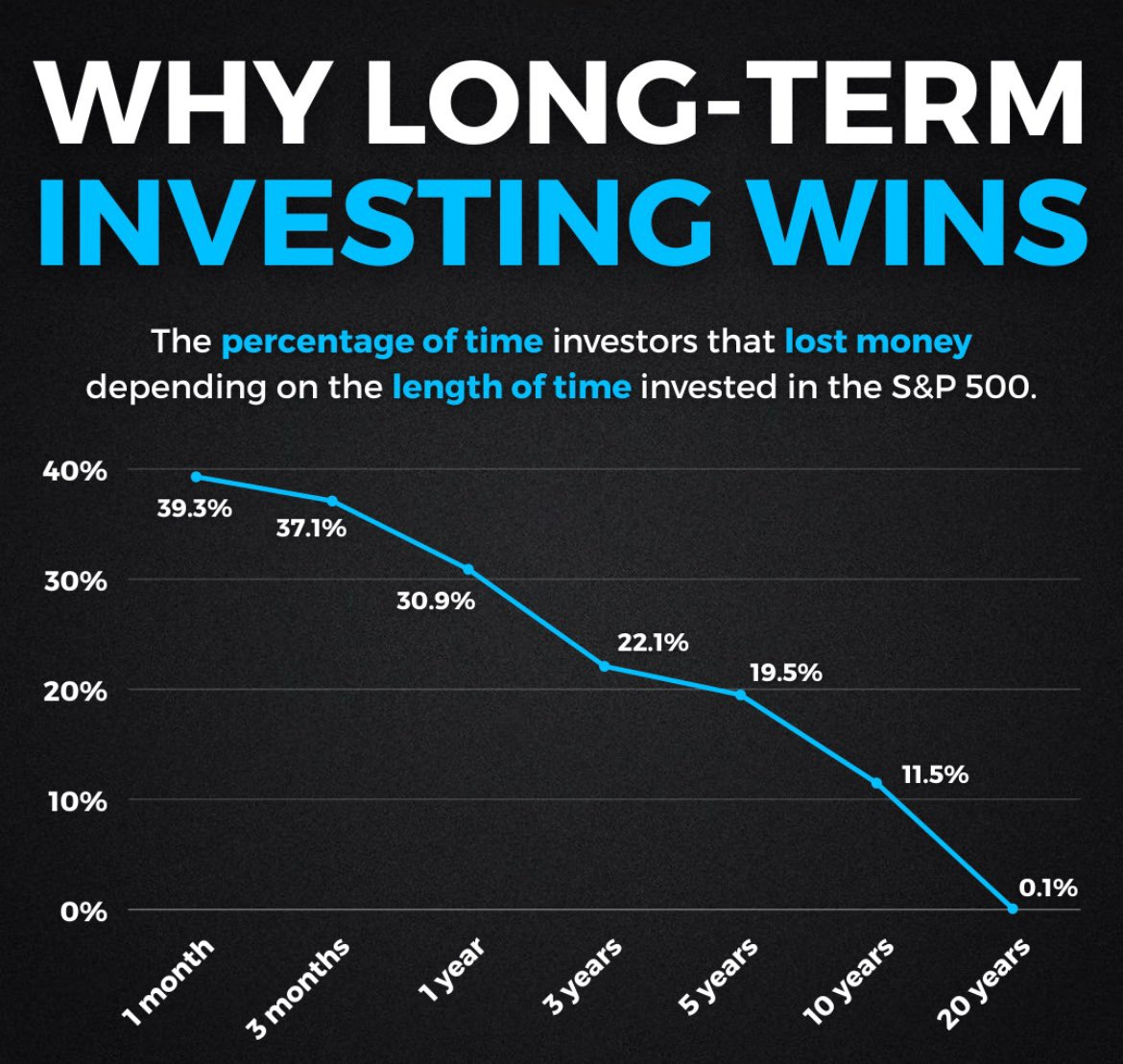

The longer your holding period, the more likely you are to make money. (See chart below) 👇

3. Don’t Uproot the Crops Before They’ve had a Chance to Grow

From 2000 to 2009, Microsoft (MSFT) saw virtually zero share price appreciation.

But over the last 10 years?

They are up over 884%.

The number rule of compounding, is don’t interrupt it.

4. Choose the Best Plants for the Soil

Individuals possess varied investing goals, risk tolerances, and time horizons.

Select investments that align with your specific circumstances.

Opt for choices based on your needs, not those hyped up by everyone else.

5. Irrigate and Fertilise

Periodic portfolio rebalancing is often essential.

As you grow older and your investment goals change, you will have to update your portfolio accordingly.

6. Remove Weeds

“Selling your winners and holding your losers is like cutting the flowers and watering the weeds.” - Peter Lynch

Sometimes you have to except there are weeds in your portfolio, and remove them.

7. You Will Have Good Seasons & Bad Seasons. You Can’t Control the Weather, Only Be Prepared for it.

We have periods of Bull markets-

And we have periods of Bear markets.

But you should stay invested.

Here’s why. 👇

These principles are the guiding tenets adhered to by the most successful investors.

When it comes to our investments, we should all seek to have the mindset of a farmer.

Dividendology

Link to download my spreadsheets: https://www.patreon.com/dividendology

Get a $50 coupon + 7 day free trial to Seeking Alpha: https://seekingalpha.me/Dividendology

What are your thoughts on having only stocks(dividend yielding) in your roth ira and etfs(dividend) in a taxable account