🚨 Warren Buffett's Berkshire Hathaway just released their latest form 13F. 🚨

This document reveals every move he made last quarter and gives us an update on his entire portfolio.

Here are 7 key takeaways you need to be aware of:

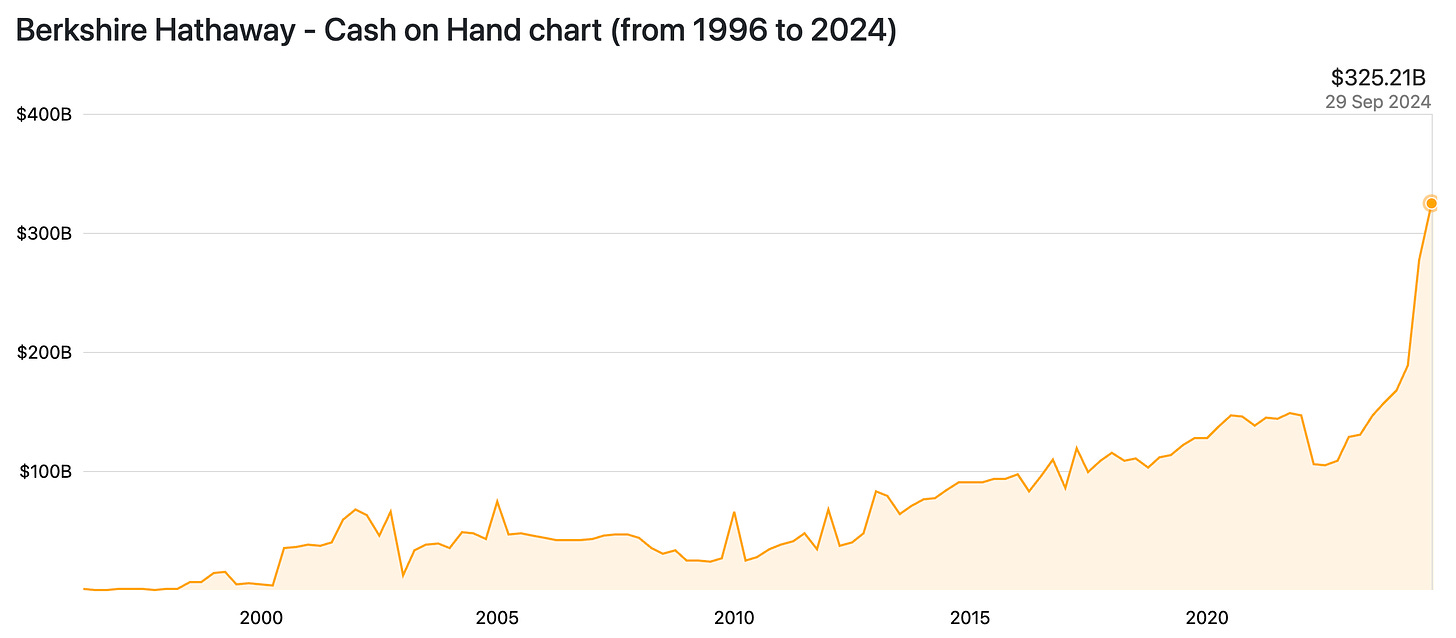

1. Massive Cash Position

Buffett's cash position is now sitting at $325 billion.

That's basically double the size of what it was a year ago.

When asked about the cash position earlier this year, Buffett stated-

"We don't have any idea how to use it (cash) effectively"

And also stated that he “is waiting to swing at the right pitch”.

2. Buffett is a Net-Seller of Stocks

In Q3 of 2024-

Buffett sold $36.1 billion of stocks.

He only bought $1.5 billion.

This means he was a net-seller of $34.6 billion of stocks.

3. Buffett's Big Bets:

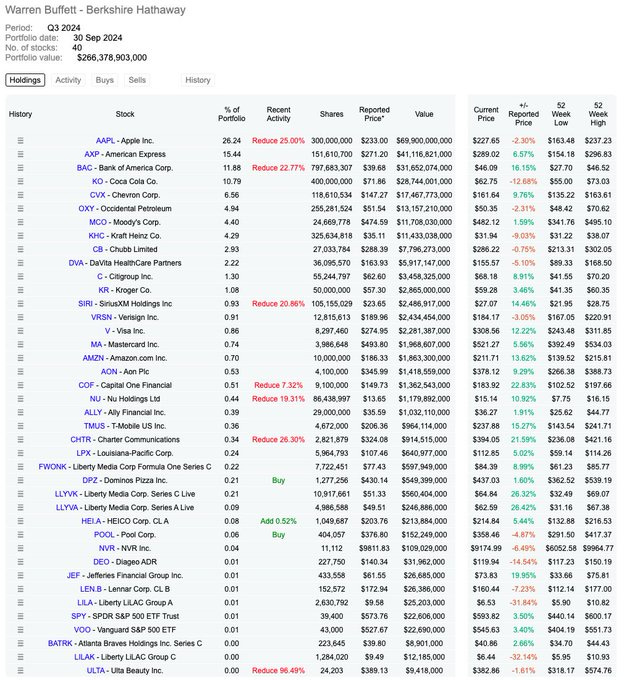

There are currently 40 holdings in Buffett's portfolio.

Buffett's top 10 holdings make up 89.68% of his portfolio.

The top 5 holdings make up 70.91% of the portfolio.

Here is a breakdown of the entire portfolio and allocation:

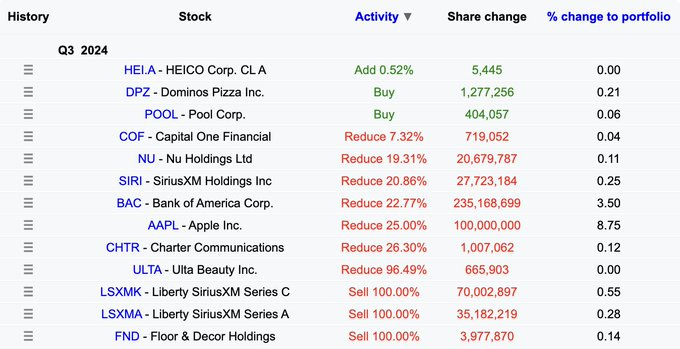

4. New Buys/Sells

Buffett added 2 new positions:

$DPZ ($550M)

$POOL ($152M)

And completely sold 3 position:

$LSXMK (-$1.48B)

$LSXMA ($-740M)

$FND (-$376M)

Here is all of his trading activity last quarter:

5. Still Selling Apple.

Buffett just reduced his $AAPL position by 25%.

In Q2 of 2023, $AAPL was 51% of his portfolio.

Last quarter it was 30.09%.

And now it is 26.24%.

Earlier this year, Buffett claimed this will still be the largest position in his portfolio.

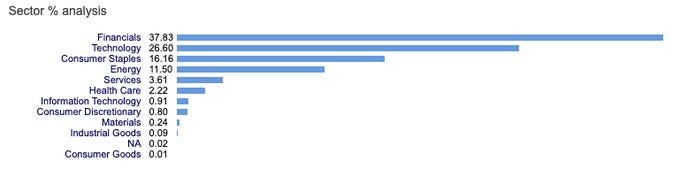

6. Sector Allocation

Technology has long been where most of Buffett's capital is allocated (due mainly to his $AAPL position).

But not any more.

Financial stocks now make up almost 38% of his portfolio.

7. Quick Facts

9 out of 10 of Buffett's largest holdings pay a dividend

The average holding period of Buffett's top 10 stocks is 8.5 years

Portfolio value is now $266 billion

Is Buffett preparing for something?

I don’t know. No one does.

But his moves from the most recent quarter would make one think that Buffett believes we are near the market top.

Being a net-seller of stocks for multiple quarters and building up his largest cash position ever has undoubtedly raised some eyebrows.

Perhaps it’s a classic Buffett move—staying cautious when others grow greedy.

Check out these resources:

Tickerdata 🚀 (My automated spreadsheets and instant stock data for Google Sheets!)

Interactive Brokers 💰 (My favorite place to buy and sell stocks all around the world!)

Seeking Alpha 🔥 (Check out the Black Friday Sale!)

The Dividend Report 📊 (Free Newsletter for Straightforward Dividend Stock News)

In Other News…

At the start of every month, I send out a newsletter to my paid newsletter subscribers with a list/spreadsheet of all the dividend stocks that I believe to be currently undervalued.

If you’d like to receive this sheet, you can sign up here:

That’s all for now!

See you next week!

Dividendology 🚀