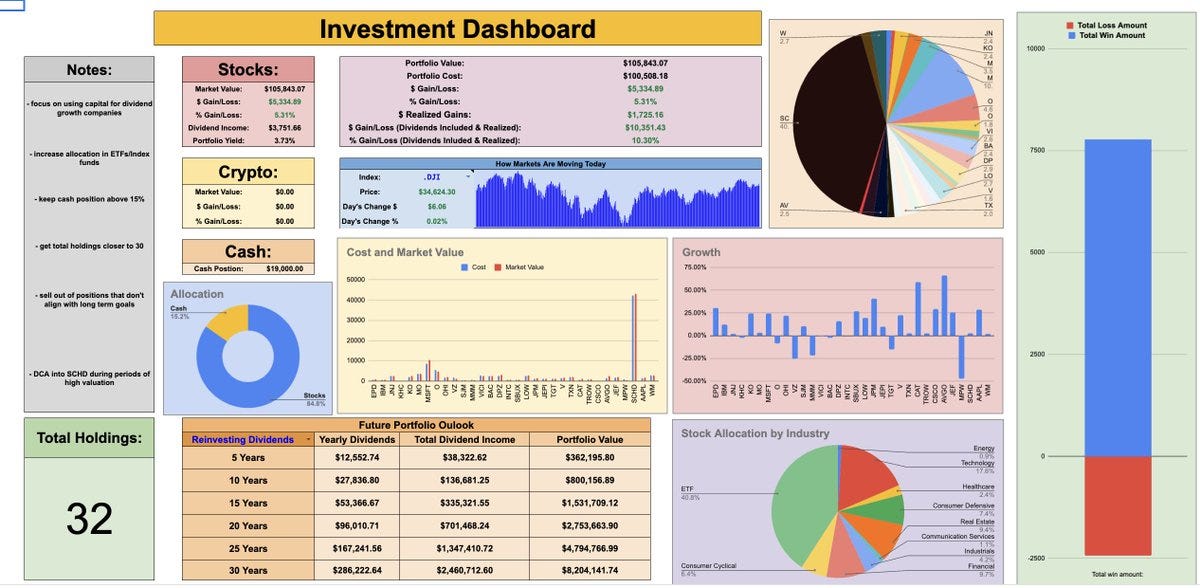

Earlier this year, my dividend portfolio hit a value of $100,000.

It took me about 7.5 years to get to this point.

My next 100k?

It will only take me about 2.5 years to achieve.

That's a pretty radical difference. How is this?

It's due to the compounding effect that really starts to kick in at 100k.

Let's look at an example.

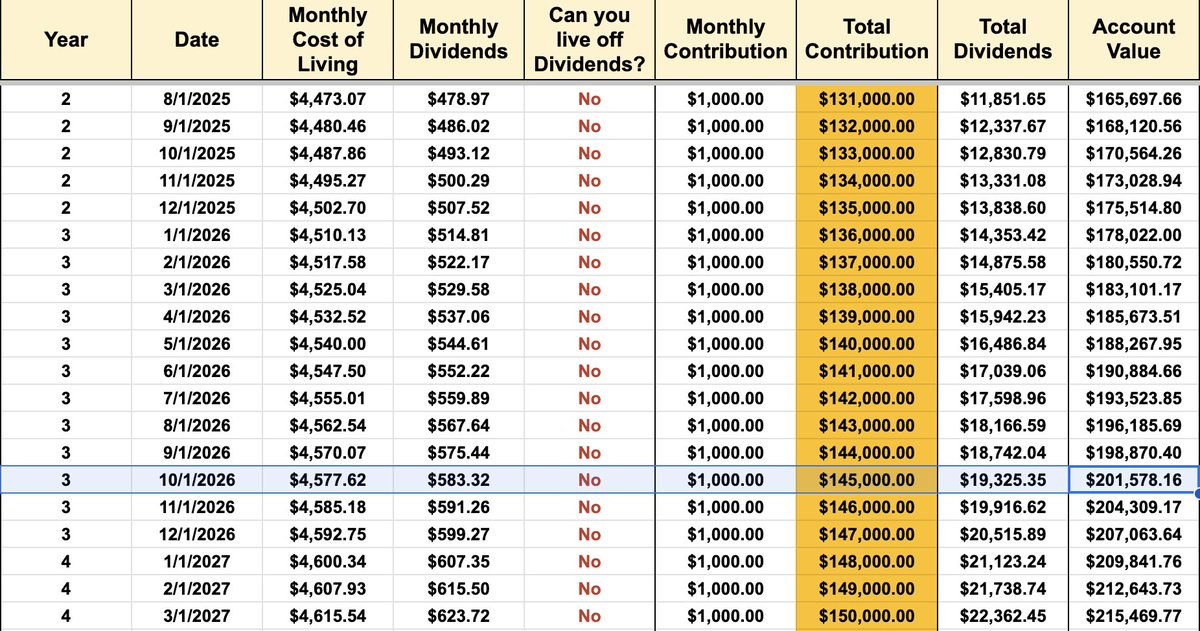

Let's say I'm starting out with $0, and plan on contributing $1,000 a month to my portfolio.

Assuming a 7% price growth rate, 7% dividend growth rate, and a 3.5% dividend yield- It would take 6 years and 2 months to hit 100k.

But what if our portfolio is already at 100k?

How long would it take to get our next 100k?

Assuming the same contributions/assumptions, it would only take 3 years and 9 months to hit our next 100k!

That's basically half the amount of time it took to hit our first 100k! (Wow!)

And the larger your portfolio is, the faster it continues to grow.

This is what's known as the snowball effect.

Just like Charlie Munger has said before, the first 100k is the hardest, but you have to find a way to do it.

And once you get to 100k?

The snowball gets rolling so fast, it's hard to stop.

Some personal news… 🔥

Starting in January, paid newsletter subscribers will be getting access to a spreadsheet every month with a list of dividend stocks that I believe to be undervalued.

This will be the result of extensive research done by myself each month.

As a result, I’ll be bumping up the price of becoming a paid newsletter subscriber in 1 month.

This means this month will be the lowest price you will ever get to become a paid subscriber.

You’ll also get access to other resources (such as spreadsheets) and insights that I only make available to paid subscribers.

With a yearly subscription, you can currently get access to all of this for only 13 cents a day.

Whenever you’re ready, join to lock in the lowest price possible.